The need for hot water in Australian homes has changed a lot over the last decade. Showers are longer. Appliances […]

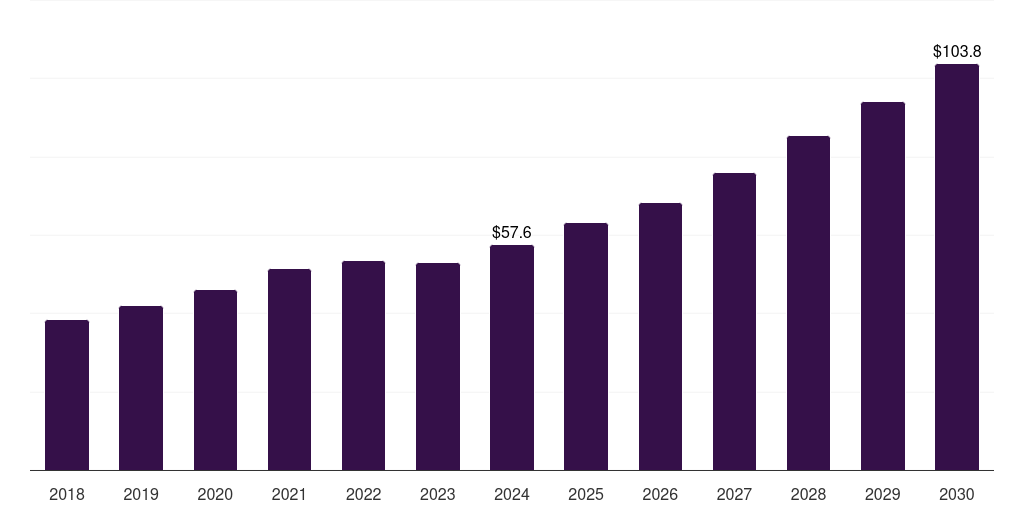

The Australian heat pump water heater market is anticipated to achieve a staggering estimated revenue of approximately US$ 103.8 million by 2030.

This is a sign of an excellent scope for expansion in this specific market segment.

Starting from 2025 up to 2030, it is predicted that the Australian market for heat pump water heaters will record a 12.1% compound annual growth rate, representing a high growth in demand and uptake of the technologies throughout the period.

| Market revenue in 2024 | USD 57.6 million |

| Market revenue in 2030 | USD 103.8 million |

| Growth rate | 12.1% (CAGR from 2025 to 2030) |

| Largest segment | Air to water |

| Fastest growing segment | Air to Water |

| Historical data | 2018 – 2023 |

| Base year | 2024 |

| Forecast period | 2025 – 2030 |

| Quantitative units | Revenue in USD million |

| Market segmentation | Air to Water, Water Source, Geothermal |

Australia’s heat pump water heater market prognosis represents this market’s current and possible future situation. This guide is a definitive reference manual intended to assist individuals and institutions handling the complexities of functioning in this market.

This publication offers sufficient market statistics, encompassing various principal factors, including revenue figures and year-over-year growth rates.

It also contains the compound annual rate of increase over varying global regions, which imparts extensive awareness of market behaviour.

The market study also entails a detailed scrutiny of heat pump water heaters, which provides corporate entities and investors with the knowledge they require to establish practical strategic blueprints for their company.

In 2024, the air-to-water segment led the market with a 70.14% revenue share.

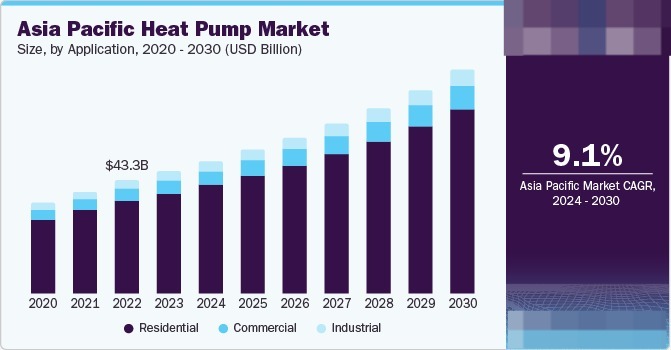

The Australia heat pump water heater market segmentation between 2018 and 2030 consists of air-to-water, water source, and geothermal segments per Horizon Databook.

The Databook functions as an extensive reference manual to help users understand this sector.

The Databook provides data about market statistics in terms of revenue alongside annual growth rates (y-o-y) and Compound Annual Growth Rates (CAGR) over the globe and its regions.

Examining the water heater market competition and opportunities enables businesses and financial investors to create effective strategic frameworks.

The gas segment achieved the largest revenue share of 45.59% during 2023.

From 2018 through 2030, Horizon Databook reports the revenue performances of each sub-segment, including electric, solar, and gas, within the Australian water heater market.

The Australian market demonstrates recovery through rising commodity prices and favourable interest rates, which should increase the demand for heating equipment, thus boosting the water heater market throughout the forecast.

The Australian Solar PV market continues to expand because of joint efforts between Chinese solar panel manufacturers and Australian technicians.

Clean Energy Regulator, Australia, reported that rooftop solar PV user numbers grew from 2.32 million in 2018 to 2.68 million in 2019, boosting the adoption of solar water heaters nationwide.

As part of its plan to transition from natural gas use, the ACT Government has banned new gas connections for buildings starting in 2023. It has also devised various energy efficiency schemes, including purchasing and installing heat pumps.

Under the Energy Efficiency Improvement Scheme, electricity retailers must help households and small and medium businesses save energy by supplying eligible energy-saving activities, including electric hot water, heat and electric space heating and cooling appliances.

Pumps, or for an Energy Savings Contribution (ESC) to the ACT Government. ESCS provide funding for energy efficiency programs under the leadership of the ACT Government.

The ACT Government has committed $150 million over five years for zero-interest loans through the Sustainable Household Scheme.

The scheme allows eligible households and individuals to access zero-interest loans of between $2,000 and $15,000 to undertake energy efficiency enhancements to their premises and homes by acquiring sustainable products like electric space heating and cooling equipment and electric hot water heat pumps.

For qualifying homeowners who possess an Australian Government Pensioner Concession Card or Department of Veterans Affairs Gold Card, the Home Energy Support Program offers 50% or $5,000 rebates to pay the upfront installation fees for these energy-efficient appliances.

Qualifying participants can apply for the interest-free Sustainable Household Scheme loan to finance the remaining installation cost.

Likewise, the Business Energy and Water Program offers small and medium businesses rebates of as much as $5,000 to transition to water-efficient and energy-efficient technologies such as heating, cooling, and hot water.

Heat pump water heaters in Australia will grow significantly because of escalating energy requirements and increasing power rates, coupled with heightened consumer understanding.

Government incentives, technological advancements, and reduced competition will propel market growth despite the high initial investment. Manufacturers, retailers, and investors will find ample business opportunities to enter the renewable energy industry through this sector.